What has the last month brought us and did we have in place the tools to combat it?

The elephant still in the room is of course Brexit and the markets are looking in anticipation for hopefully a deal to come out of the EU.

In a very simplistic way some have seen that covid-19 might act as a benefit to the UK as the whole of Europe is slowly, hopefully, beginning to recover from this this pandemic and each country is starting to rebuild its economy. No matter which side of the channel you sit the emphasis on ‘getting back to normal’ has to be every country’s priority and hopefully the negotiators for the EU will see that the UK is a country that the rest of Europe wants and needs to do business with, in order to recover, and won’t over anxious about their memoirs in a few years’ time.

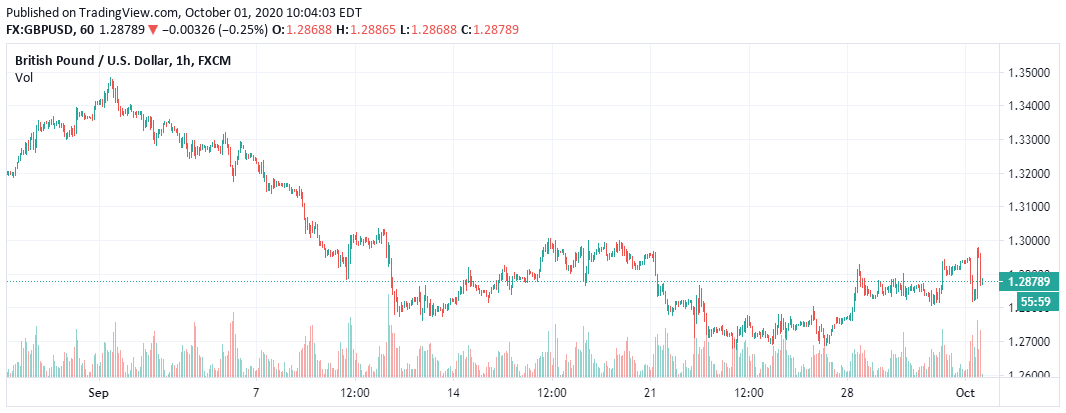

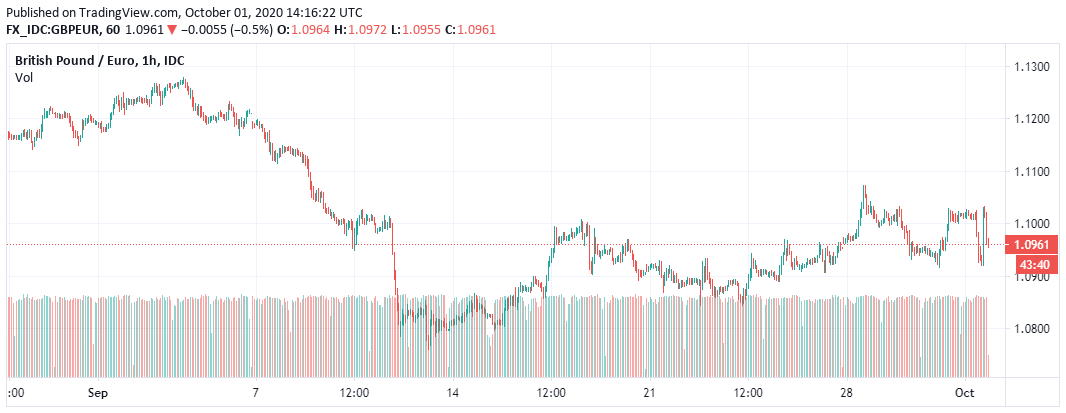

So what have we seen on the markets in the last month? The pound against the dollar has fallen from highs of 1.3480 on the 1st September to lows of 1.2680 on the 25th, how has this affected your business in terms of buying or selling currency? We can also see, below the pound against the Euro for the same period, with highs of 1.1277 on the 3rd September and lows of 1.0764 on the 11th, a movement of 4.76%.

Any importer or exporter would have found this period of time quite challenging, either hoping to second guess what to do next or to follow closely what the market was likely to do and was it time to hedge for the coming months.

Whatever your strategy all the elements such as Covid, Brexit and the US elections coupled with domestic fears of growing debt and a second wave winter outbreak made decisions difficult but please remember you are not currency traders but business people running successful companies so as long as the currency you do buy covers the cost of your products and services and you have hopefully made your required margin you have achieve what you set out to do.

However what lessons have you learnt if you have not succeeded as you would wish?

Do you have a proactive treasury function within or outside your organisation which fulfils this role?

Were you kept in touch by your accounts department or currency supplier to keep you advised of such movements in the market, or did the beneficial levels pass you by?

What lessons can be learnt from the highs and lows of all currencies over the period?

We believe that the treasury function within companies does not necessary need to be over complicated, as long an eye is kept on the market and there is a strategy in place then margins and profits can be sustained.