What is your strategy this year for the buying and selling of currency for your business?

Focusing mainly on the movement of GBP against the euro and the US dollar we have been bombarded with a realm of factors which were an uncertainty last year, but now seem to be more decided. It has to be said that the pound, since the turn of the beginning of 2021, has slowly but surely increased in value against the two major markets. Some would say this is unsurprising.

The dollar chart above shows effect from the American elections and since the ever-increasing debate of Deal or No Deal has been put to rest, finally, we have seen, the dollar’s trading range between 1.3450 and 1.3760 since the beginning of the year. Is this good for you or not?

‘No Deal’ nerves were very evident in the run up to the final deal at New Year. Very sensibly on the import side, we saw the consolidation of margins being secured throughout November and December as the rates got better and individual targets were reached, with the never-ending chance that a no deal would become a reality. Consequently, on the sell dollar side, i.e. exporters, we saw a lot of clients protecting their dollar income by forward selling positions with the chance that the dollar could end up nearing the 1.4 level.

Whatever was done seems to have worked out reasonably well for all. A Brexit deal was done which eradicated a huge amount of uncertainty in the market but the pound didn’t reach some of the highs that were expected due, mainly to the Covid situation and the lock-down which began on January 5th. Both buyers and sellers of dollars have seen the market move maybe predictably but not too much either way as to be unhappy with their hedged positon.

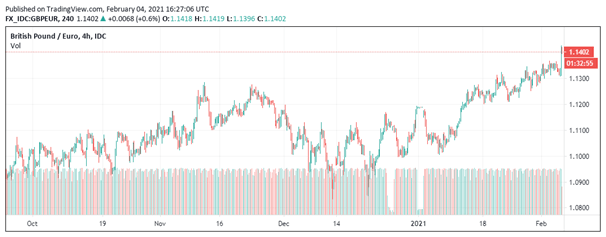

Now on to the euro.

The strength of the pound against the euro did focus more on the toing and froing of the Brexit deal continuously during the two-month period before the end of the year. It was always going to be a last-minute decision, but throughout December especially, the uncertainties did have a sometimes unnerving atmosphere of what the end result really was going to be.

No Deal nerves, as with the dollar, certainly were evident but I think the market was never really likely to go extremely one way or the other as the small print of the deal and Covid still hung heavily over both the UK and the EU.

Buyers and sellers were equally cautious. Euro buyers weren’t really too fussed about forward buying but did have stop losses at the ready just in case a no deal became a reality. Thankfully for them, it didn’t. Recently, the strength of the pound or weakness of the euro hasn’t quite got to the level worth fixing in at.

Sellers were slightly more proactive hoping to get in to the market, in part, if the rate was attainable below the 1.10 level, but mainly rode out the decision and accepted forward selling at the slightly higher rate once the decision came through.

All in all, volumes of trades were obviously taken in-to account based on how the deal would pan out and whether there would be ‘business as usual’ starting the New Year

What is your strategy for 2021? What is your ever present exposure to the currency markets? Are you dealing in any other currency, not just GBP, USD and EUR, but all major currencies?

What change are we in the UK going to see in the next month or so as the Covid vaccine gets rolled out and the economies and businesses get back up and running?

The UK seems to be the country leading the vaccine race. Will this have a major positive effect on the pound?. If so, are you prepared for a possible 1.20 Euro and 1.4+ dollar in the coming months?

Did you end up with a currency loss on your P/L balance sheet last year?. If so why? We can work closely with you to negate such losses and make sure all deals end with a profit margin.

Please do get in touch if you wish to discuss anything about this blog or would like to discuss your companies hedging strategy.